Could a gap tax year help economy?

Fallow is an agricultural technique that consists of not sowing the arable land during one or more growing seasons.

Some advantages of this agricultural practice are the recovery of soil fertility, moving it to the surface, preparing crops for the next few years and ensuring the quality of future crops.

Is it possible to apply the same technique on the tax system, moving and boosting the economy, recovering businesses and preparing a fertile field for the next years?

What taxes are used for?

In general, taxation is an important tool for governments to generate revenue, redistribute wealth, and promote economic growth and stability. Depending on the specific tax policies and regulations in place, reducing or eliminating taxes could potentially have a range of effects on the economy, such as increasing consumer spending, incentivizing investment and job creation.

However, it is also important to consider the potential trade-offs and unintended consequences of such a policy. For example, reducing taxes could lead to higher budget deficits and national debt, which could undermine long-term economic stability and prosperity.

It's also good to consider that the impact of any tax policy on the economy depends on a variety of factors, including the overall economic context, the distributional effects of the policy, and the effectiveness of any accompanying policy measures or regulations.

What hypothetically would happen if we zero (or reducing drastically) taxes every X years?

First of all we need to make some assumptions:

- We are going to analyse only economic numerical part, in this case we are not able to predict the economic agent moves (self interest).

- We do not distinguish the types of business but take an avarage growth rate of 10% and every saved in taxes will be reinvested.

- Consider the X = 4 by gut instinct (not a scientific method by the way) so we don't choke the governing economy frequently

- We will consider a generic economy with a fix 26% tax rate.

- It's important to not reduce drastically the country budget used for a common services (health, education, infrastructure etc...)

- We are not able to calculate the exactly ROI once the gap years come

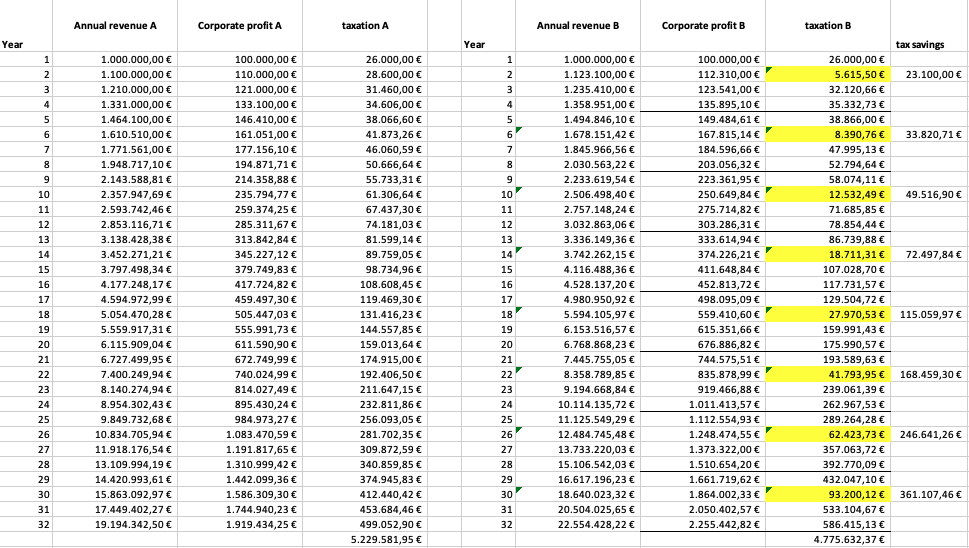

Considering an economy like the one in the spreadsheet below and considering the gap years with a 5% tax rate, we can see that in the first four years we would have a significant increase in company revenue and profit. As a result, however, a significantly lower tax collection. Not the best result in the short term.

But, let's see what would happen if this type of economy continued. As we can see year after year the company profit is higher if gap year is introduced. Similarly taxes rise along with profits.

In this example we see that after 32 years from the application of the preferential taxation, the taxes are still lower than those that could be collected but the gap decreases every year. In this case, after 32 years, the uncollected taxes will be approximately $450K but the corporate net income will be over $2.5M more. Not a bad trade-off.

Doing some math, with this approach, it's possible to reach the same amount of taxes of traditional way in 40 years and a net company profit of over $5M. But, as previously mentioned, we cannot calculate the exact ROI of the company once a lower tax has been applied. Indeed, the tax savings could be invested in research and development, innovation, hiring of new staff and in many other ways. In this way, by investing well the saved money , the return could be even higher than the considered 10% and the tax gap could be covered faster.

This type of technique appears to have advantages in both the long and short term. We have obtained a tax saving for companies in the short term and, over the long term, we've seen an increase in corporate profit and tax rate for government.

Such an approximate calculation made on Saturday evening is probably not enough to solve the tax problem, but it could be an idea for a more precise real future analysis.